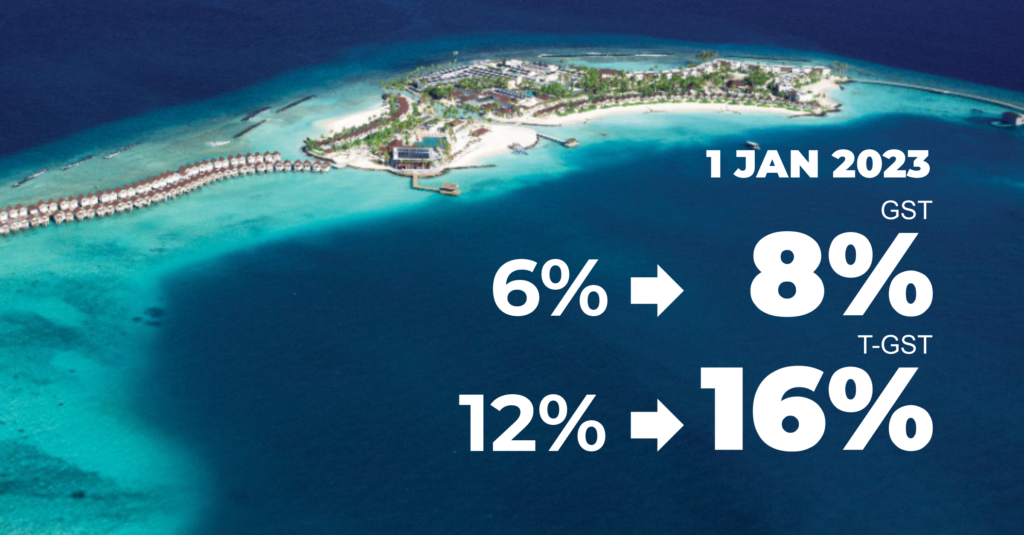

Since the Goods and Services Tax Act[1] came into force in the year 2011, it has been amended six times. The latest being the Sixth Amendment[2], which was ratified by the President of the Maldives on the 22nd of November 2022, which would come into force on the 01st of January 2023.

Businesses that are registered for Goods and Services Tax (GST) and Tourism Goods and Services Tax (TGST) must grasp the ramifications of this most recent amendment from an operational perspective in order to adequately prepare for the upcoming GST and TGST increase from a compliance standpoint before the most recent amendment comes into force.

Accordingly, below are the key changes brought on by this most recent amendment.

|

GENERAL SECTOR – GST

|

Current Rate | Rate as of 1st of January 2023 |

| 6% | 8% |

|

TOURISM SECTOR – GST

|

Current Rate | Rate as of 1st of January 2023 |

| 12% | 16% |

Businesses should be mindful that the time of supply determines the date on which a good or service is supplied for the purpose of accounting for tax.

“Time of supply” refers to the date on which the tax invoice for a supply is raised or the date on which payment for that supply is received, whichever comes first.

Therefore, GST or TGST must be charged inclusive of the new rates only where the “time of supply” of a transaction occurs on or after the 01st of January 2023.

Businesses should ensure to amend and display prices inclusive of the new GST and TGST rates applicable from the 01st of January 2023. This will include bringing the necessary changes to all forms of advertisements published with the prices inclusive of the previous GST and TGST rates.

Furthermore, the changes should be made to POS, accounting, invoicing and reservations systems to reflect the changes brought on by the increase in the rate of GST and TGST.

Additionally, it is crucial to review any existing contracts to determine any obligations that the business may have to bear as a result of the increase in GST and TGST rates.